Greater margin, more satisfied channel partners and more transparency through professional contract management.

Exectuive Summary

With margins that are sometimes above 50 per cent, it is highly profitable for OEMs (original equipment manufacturers) to renew existing contracts. According to Morgan Stanley the share of recurring service revenues in total earnings rose from 30 to over 40 per cent for OEMs last year. Yet despite this level of significance, the renewal of active and expiring maintenance, support and service contracts is almost at the bottom of priorities among senior management. According to Gartner, investments in recurring revenues are given 13th place (out of 14) by CEOs.

Renewals have low energy for senior management.

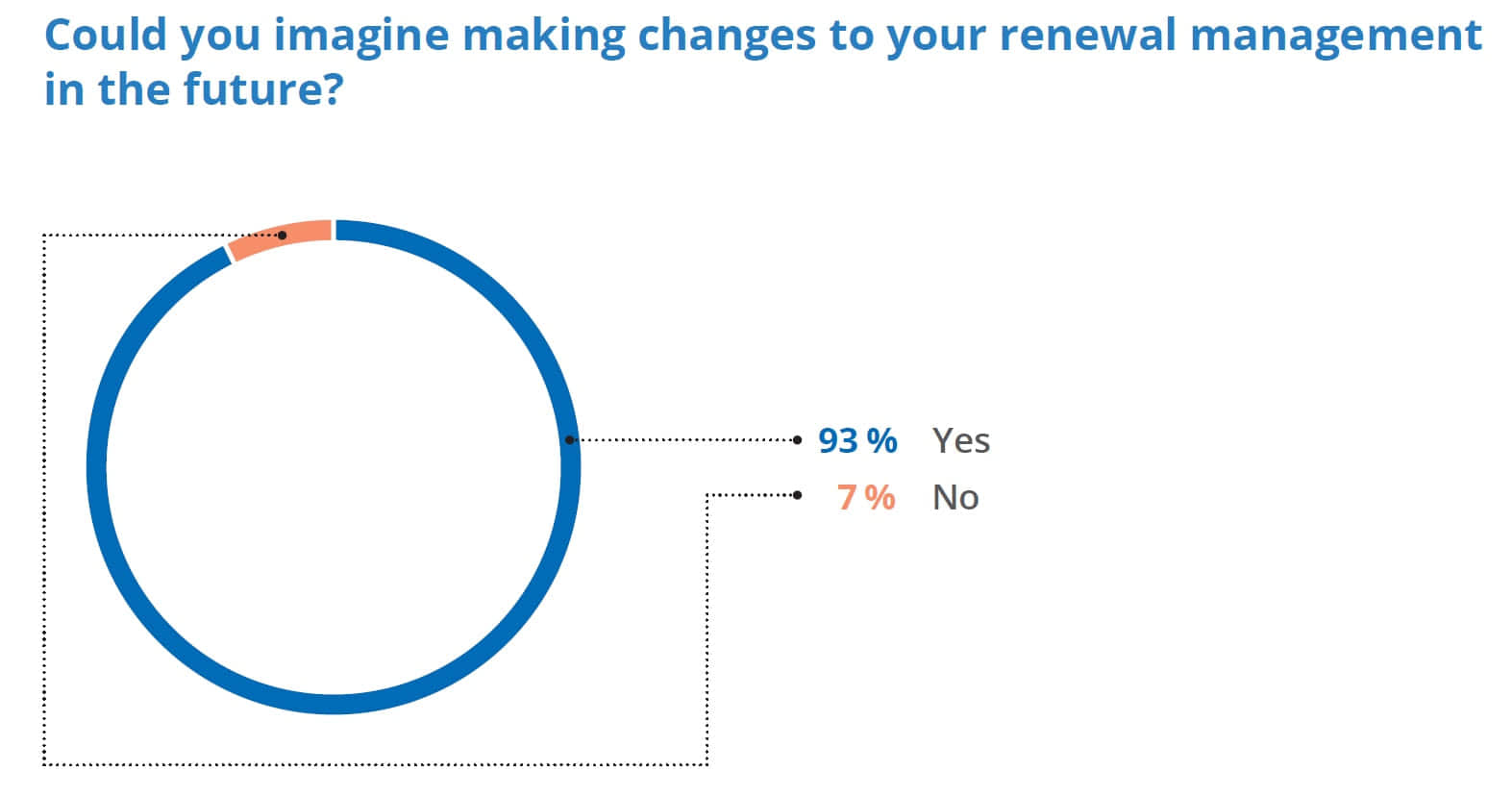

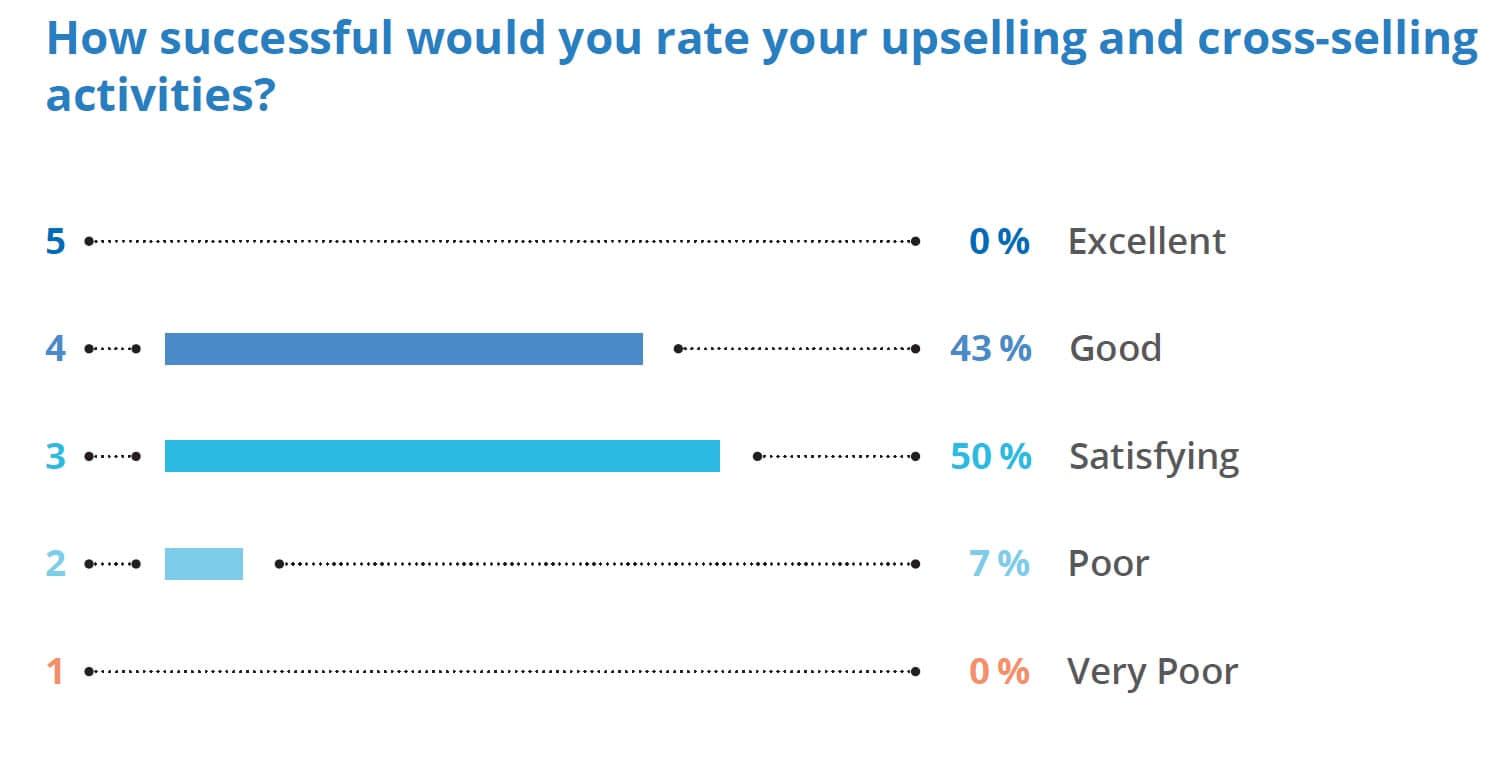

Room for optimisation can also be found among those with direct responsibilities for renewal management. This emerged recently from a survey conducted by Annuity Management AG, a company which specialises in the management of revenue lifecycles and service revenues. The survey shows that over half of the respondents make no distinction between direct and indirect renewal business and over 60 per cent are not directly measuring upselling or cross-selling results. This lack of focus on existing customer relations can be very costly. The acquisition of new customers does, after all, require up to seven times as much investment as efforts to retain existing customers, and every additional euro earned through cross-selling and upselling can pay its way up to five times as much through contract renewals.

60 percent of renewal managers do not measure the success of up-selling and cross-selling activities deirecty.

One element that plays a particularly important role in contract management is the channel. 85 per cent of the manufacturers surveyed by Annuity Management AG use the channel either as an exclusive method of distribution (14 per cent) or in Renewals have low priority for senior management. 60 per cent of renewal managers do not measure the success of upselling and crossselling activities directly. parallel with their direct business (71 per cent). Nevertheless, indirect distribution is not included and supported in renewal management as much as might be necessary, even though over 60 per cent of the respondents surveyed by Annuity Management feel that there is a need for action when it comes to looking after channel partners in their renewal management.

85 percent of the manufacturers use the channel as a method of distribution.

Furthermore, several factors make it difficult for the channel to ensure successful renewal management. Quite often the responsibilities for a customer’s contracts are not bundled, either for the manufacturer or the distributor, so that the impending renewal cannot be managed in any standard or consistent manner. Also, there are potential channel conflicts when manufacturers decide to handle lucrative contract renewals themselves, while passing on relatively low-revenue renewals to their partners.

Lack of consistent management and potential channel conflicts make renewal business difficult.

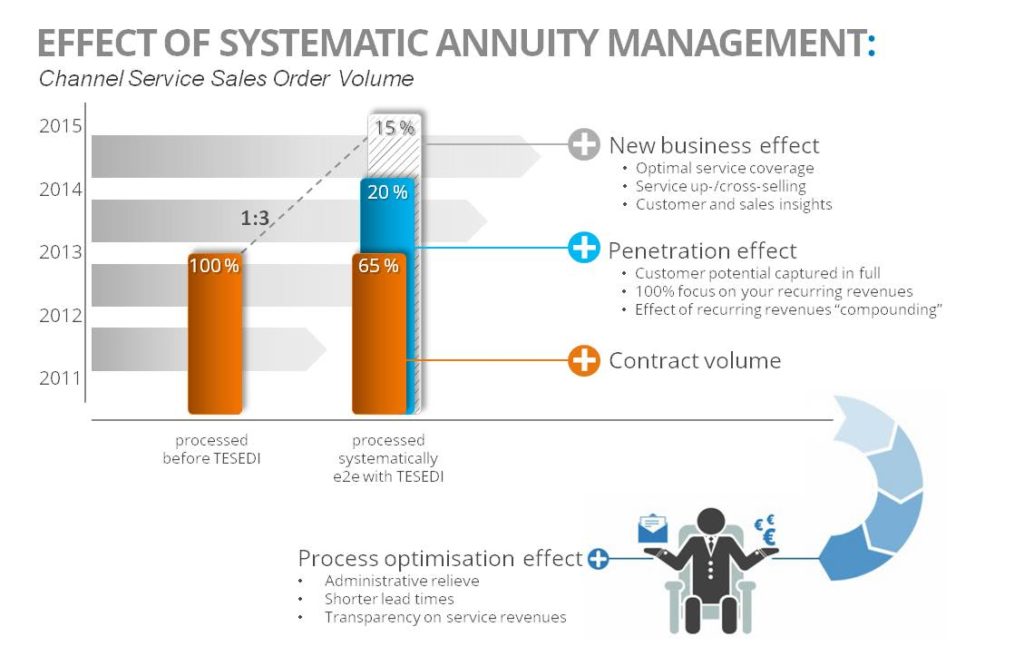

To solve these problems, to make renewal management attractive for the channel and thus to achieve a significant increase in the rate and volume of contracts, it seems worthwhile to use a neutral contractor who specialises in renewals. Such a contractor then bundles and supports all the activities involved in renewal management. Partners can be confident that they will not be sidelined in the contract management, that they can offer the best possible support for their customers and that they can achieve a substantial return on investment when they contact customers and negotiate contract renewals. Using the example of renewal management for Hewlett Packard Enterprise (HPE) Germany, the White Paper shows how such a professional partner can help to boost the renewal rate by up to 20 per cent per year.

A professional partner can help to boost the renewal rate by up to 20% per year.

Introduction

To solve these problems, to make renewal management attractive for the channel and thus to achieve a significant increase in the rate and volume of contracts, it seems worthwhile to use a neutral contractor who specialises in renewals. Such a contractor then bundles and supports all the activities involved in renewal management. Partners can be confident that they will not be sidelined in the contract management, that they can offer the best possible support for their customers and that they can achieve a substantial return on investment when they contact customers and negotiate contract renewals. Using the example of renewal management for Hewlett Packard Enterprise (HPE) Germany, the White Paper shows how such a professional partner can help to boost the renewal rate by up to 20 per cent per year.

Renewal manager's perspective

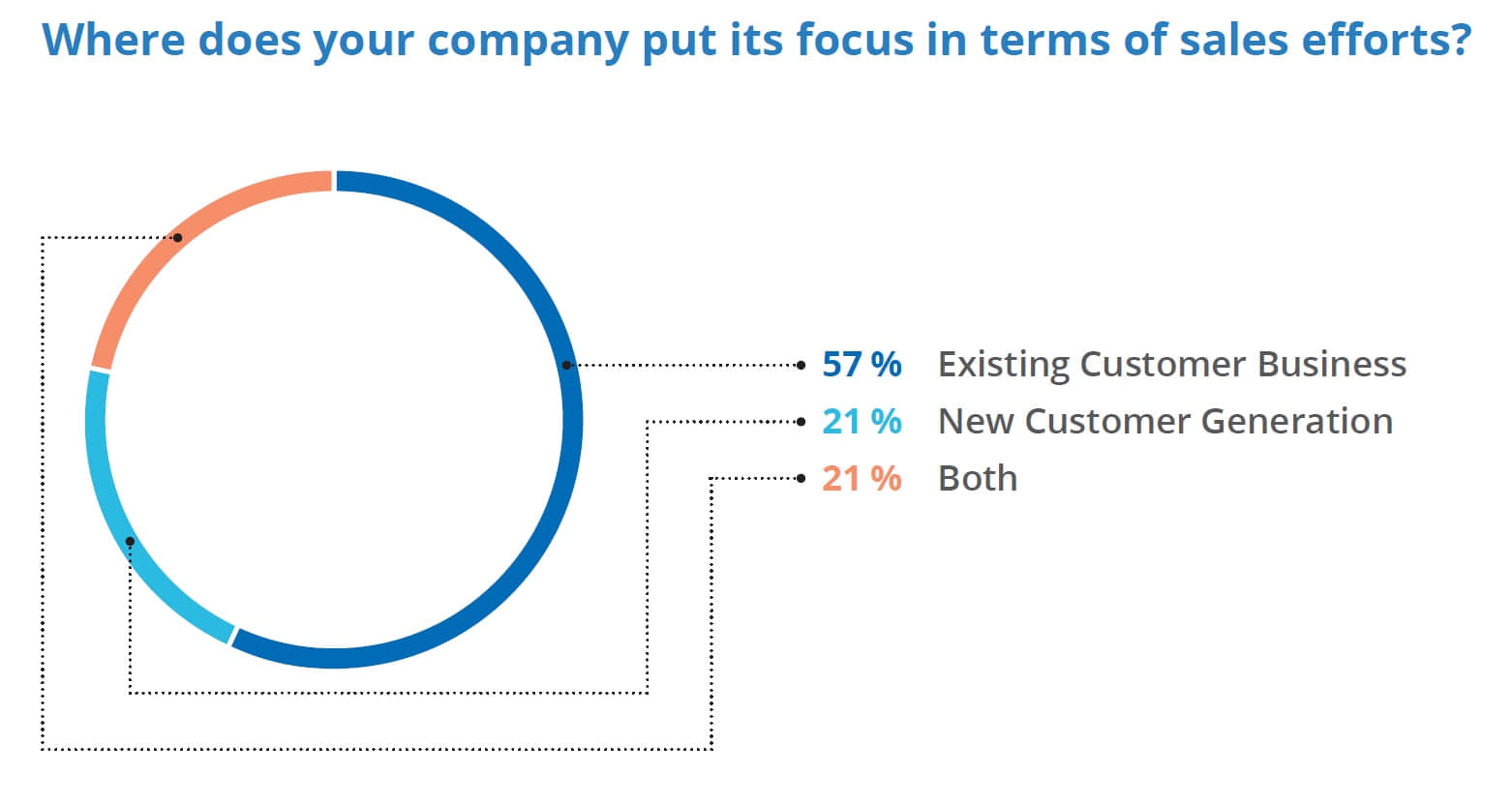

More than half of all renewal managers put the main focus on managing existing customers, while 21 per cent believe that it is at least as important to focus on retaining existing customers as it is to acquire new ones. This was the result of a survey by Annuity Management among 18 major manufacturers in the IT industry, including Dell, Hewlett Packard Enterprise, IBM, Microsoft, Cisco and SAP as well as companies in other industries such as Phillips and Abbott Laboratories. Over 80 per cent of OEMs in the survey say they used the channel as a method of distribution, and 14 per cent even use it exclusively. On average, 56 per cent of revenue is made via the channel, and 80 per cent of customers are served through the channel.

At the same time, service business is increasing in importance. Just under 80 per cent of respondents describe it as “important” or “very important”. It has an average revenue share of 38 per cent (and the percentage is rising). 86 per cent of respondents see renewal management as “important” or “very important”. 71 per cent have dedicated teams for it, and 21 per cent use external contractors for this purpose. Only 7 per cent of respondents say they have no specific renewal managers.

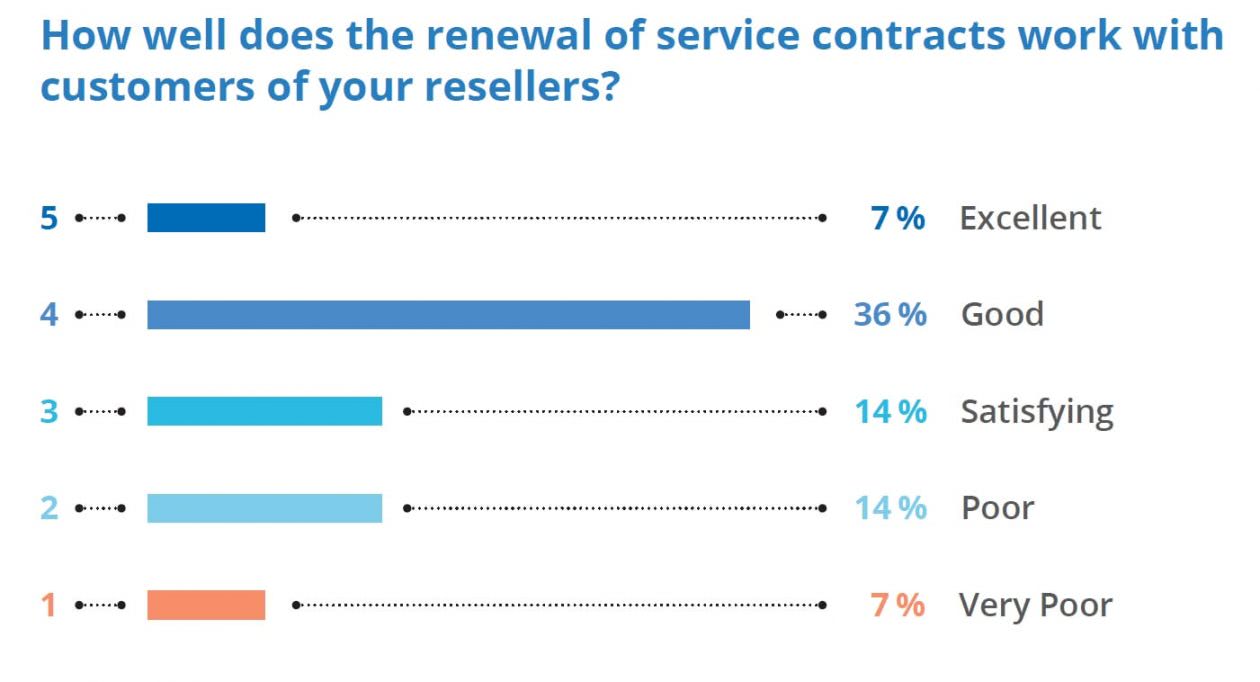

Nearly 90 per cent of respondents describe their renewal management as “very good” or “outstanding”. Companies are somewhat less satisfied with renewal management where customers of their channel partners are concerned. This is an area where only 43 per cent give top ratings. However, half of all respondents do not distinguish between indirect and direct sales in renewal management. Over half show only average or below-average satisfaction with their upselling and cross-selling processes. Half of all respondents doubt whether the existing measures are sufficient to leverage the full potential of renewal management.

Senior management perspective

While renewal managers are at least partially aware of the need to ensure the retention of existing customers, this awareness is missing almost completely at the senior management level. According to Gartner, investments in recurring revenues are given 13th place (out of 14) by CEOs. This has also been confirmed in the Annuity Management survey which found that 65 per cent of the surveyed renewal managers feel there is no interest among senior managers. 80 per cent say that this area is suffering from gross underinvestment.

Channel partners' perspective

Renewal management processes are often seen by channel partners as obscure. The responsibilities for a customer’s contracts are distributed across different manufacturer’s departments and several distributors. Instead of receiving a standard view of a customer’s renewal situation, partners have to deal with a large number of small contracts which are not coordinated among themselves and which have very different terms. Sometimes the partner even receives incorrect or outdated information from the manufacturer. Moreover, if a company handles contract renewal both directly and indirectly, this may cause conflicts within the channel. As a result, channel partners cannot be sure whether all of a customer’s contracts have really been submitted to them or whether the manufacturer may perhaps be trying to conclude especially lucrative renewals directly.

This lack of transparency makes it difficult to ensure successful renewal management for a partner. There is no trust and no motivation to invest more time, energy or resources in the renewal of contracts. An Annuity Management survey among channel partners shows that over 90 per cent would welcome more proactive support for their renewal management.

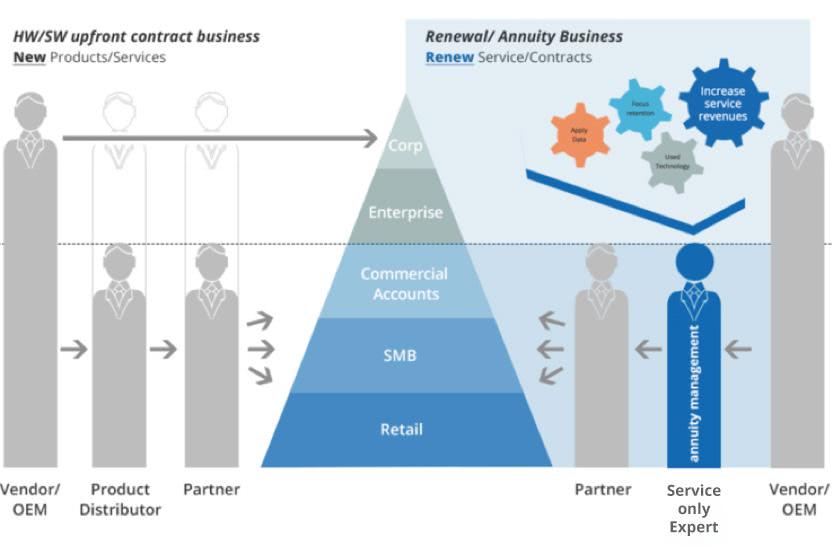

The role of the service-only expert in renewal management

Both manufacturers and channel partners are overwhelmed by the full-scale management of contract renewals. This is where neutral specialists can be helpful, as they can provide more efficient processes, state-of-the-art IT and a clear focus. Ultimately, this shows itself in a higher renewal rate and more business through upselling and cross-selling.

The service-only expert plays a crucial role in this process. Being totally focused on the renewal of service contracts, such a specialist does not compete with the manufacturer, with up-front distributors or with resellers. Instead, their only role is that of an expert on service contracts and, as such, they proactively support the entire renewal process. Experts support the channel in selling renewals, in monitoring performance, in writing quotations, in discovering potentially new upselling/cross-selling business in the service area, in tracking the conclusion of renewals and in managing financial accounting.

Case study: Annuity management at Hewlett Packard Enterprise

Hewlett Packard Enterprise (HPE) is a global technology group that offers a wide range of professional hard and software as well as IT services and solutions. With over $30 billion in revenue per year and business activities in over 100 countries, HPE pursues a channel-focused approach in marketing its products and services.

The renewal management at HPE Germany gave the company a major challenge, due to its level of complexity. It was facing a situation of multi-channel distribution, a complex IT landscape with a large variety of data sources and points of contact and continually changing hardware configurations that often required new service level agreements and software and licence updates.

HPE Germany understood that its channel partners needed support in managing their existing service and maintenance contracts. For example, partners were not receiving the information they needed for correct quotations, did not have up-to-date customer details and were not using any upselling potential. Another element that made contract renewals unattractive was the amount of time that had to be invested in managing them.

As a result, the company’s renewal rates failed to meet expectations, partners were frustrated and corporate customers were left without the necessary service and maintenance contracts. Not only did this have a negative effect on customer satisfaction, but it also prevented any systematic approach to new business.

HPE Germany therefore wanted to find an expert in annuity management. It chose Tesedi, a subsidiary of Annuity Management AG. Tesedi specialises 100 per cent in renewal management services. It does not sell hard or software, so that it has a very clear focus and is trusted by manufacturers, distributors and the channel. Supported by a suite of highly specialised IT systems, Tesedi covers the entire lifecycle of renewal management, from the registration of new contracts and partners, through the tracking of all renewal-specific information, to the provision of sales support and contract optimisation. Tesedi also supports HPE channel partners by ensuring correct profiling and pricing and by offering contracts.

Thanks to support from Tesedi, HPE more than tripled its renewal revenue in its core markets – Germany and Switzerland – over the last six years, with the average contract volume being about EUR 12,000. This is all the more crucial as each renewal contract brings in recurring revenues for about five years. Tesedi has calculated that every euro made through renewal management can be multiplied by a factor of 3.4, including a 20% tech refresh per year. In addition, renewal management has led to an average 10-15% increase in new business per year.

Conclusion

The importance of ensuring the retention of existing customers has so far failed to penetrate to the senior management level. Sales and marketing continue to focus on acquiring new customers, even though this is up to 7 times more expensive than endeavouring to retain existing ones. Pent-up demand can be observed, in particular, in renewal management via channel partners. Renewal management via the channel is complex, long-winded and effective due to the complexity of contracts and supply chains, inadequate and incorrect information from manufacturers and distributors and also potential channel conflict between direct and indirect sales. Not surprisingly, therefore, partners want to see more support for the renewal of service and maintenance contracts.

This support can best be provided by neutral contractors focus on renewal business alone. Such experts can warrant a standard and consistent renewal management, create transparency and ensure that the process is handled professionally and on time. Acting as interfaces between manufacturers, distributors, the channel and customers, they can place renewal management on a totally new level, thus achieving long-term revenue increases of over 20 per cent per year.

Related Solution

With the neutral service-only positioning, the channel renewal support service supports both distribution and IT resellers in all renewal management tasks.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!