How Resellers can benefit from the IT as a service trend

Services such as HPE GreenLake enable customers to use IT resources in their own data centre without having to purchase them. This business model presents resellers with a number of challenges, but it entails many opportunities too.

Agility has become a key competitive factor for all businesses in recent years. Even before the coronavirus crisis, being able to respond quickly to market conditions and activate IT resources in next to no time was crucial to survival. There is also the fact that fewer and fewer companies are willing to invest in IT assets. Purchasing hardware and software ties up a lot of capital and makes acting flexibly more difficult. No wonder so many firms have opted to go in the direction of the cloud. However, not all tasks can be satisfactorily managed with cloud-based resources. Latency-sensitive workloads in particular can soon become a problem. The savings you initially make by moving over to the cloud soon become quite the opposite when usage increases sharply, the provider hikes their prices or you find yourself needing to book additional services that nobody initially thought about.

For many companies of all different sizes, a good alternative can therefore be to use IT as a service from their own data centre as offered, for example, by Hewlett Packard Enterprise (HPE) with its brand GreenLake. Not only does this model save companies from investments without their having to put up with the disadvantages of the cloud – it can even also generate additional liquidity as HPE offers the purchase of existing hardware, which can then be integrated into the GreenLake environment. This means the existing assets remain where they are, but are no longer a burden on the investment budget – an advantage which is not to be underestimated and which can even be crucial for a company‘s survival, especially in times of crisis when many companies’ turnovers simply dry up, as is currently the case.

How organisations benefit from the ‘IT as a service’ model

GreenLake is predestined for use by companies and public institutions of all sizes whose IT requirements increase rapidly or fluctuate greatly. The primary target groups include service providers, banks and insurance companies and also hospitals. The health care system’s requirements in the areas of data processing and storage have increased significantly in recent years with imaging processes involving ever greater resolutions, the digitalisation of patient records and the use of modern analysis and diagnostics methods based on big data and artificial intelligence. And this trend will continue. GreenLake offers these organisations fast and straightforward growth without their having to contemplate long planning periods and high investment costs.

University Hospital Bonn (UKB) is an example of the successful application of HPE GreenLake. The hospital covers a very broad spectrum ranging from patient care to research and teaching. Since 2018, the hospital has been offering doctors and nursing staff virtually paperless workflows, and this has increased the demands made of the IT systems further still. The storage solution previously used was not up to this task and there were multiple system outages – an untenable state of affairs for a maximum care hospital such as the UKB. Together with the IT partner Hansen & Gieraths (H&G), the UKB therefore went in search of a high-availability solution which could cope with the demands of modern digitalised workflows. They chose HPE’s ‘IT as a service’ model GreenLake, which not only offered the required level of performance and reliability, but also significantly increased flexibility. When involved in research projects or when there are unexpected patient care peaks, as is the case in the current coronavirus crisis, the UKB can simply book additional storage without any time delays and without any additional investments. A positive side effect of this is that the ‘IT as a service’ model makes buying and providing resources superfluous and frees up capital, which can then be used for strategically more important measures. Thanks to the improved utilisation of its storage capacities, the UKB was able to significantly reduce its IT costs. What’s more, the greater availability and reliability of the new systems boosted user satisfaction.

Other areas which can benefit greatly from IT as a service are bricks-and-mortar and digital wholesale and retail. This industry is used to experiencing peak loads, for example at the end of the year, while considerably less turnover is generated in the summer months. With the traditional purchasing model, this means companies have to have IT resources at the ready for peak times, which then remain largely unused for the rest of the year. If a company is operating on an overly tight budget, there is the risk that outages or delays may occur precisely when turnover is at its highest, while overcapacity leads to costs and capital tie-up without the purchased capacities ever being used.

The flexible provision of capacity, as is the case with HPE GreenLake, can remedy this situation. Ten per cent additional capacity is kept available in the customer’s data centre at all times, thus minimising the risk of bottlenecks even in the event of unforeseen peak loads.

IT as a service – a challenge and an opportunity for resellers

Consumption-based billing fundamentally changes the sales process for systems suppliers and IT integrators. At three to six months, the sales process generally lasts longer than with straightforward hardware businesses. Additionally, IT as a service cannot only be sold on the basis of the technical features. Instead, the focus has to be placed on the economic benefit. In addition to technical matters, resellers therefore have to also have a basic understanding of financial management in order to be able to credibly present the advantages of an opex model over a capex model. Business relations change too – the primary customer contact for the reseller is no longer the head of IT, but the CFO, who needs to be won over with an attractive business case. It is not easy for the sales team to forge the right links here. In many cases, the managing director or CEO making use of their industry contacts can help here, paving the way for contact to be established with a customer’s business decision makers.

This fundamentally different sales cycle means resellers not only have a greater need for training, but also and above all have to undergo a fundamental change in their mindset. Resellers need to not only understand but also themselves practise the principles of IT service management and agility. It is worth the effort as selling ‘IT as a service’ models such as HPE GreenLake offers a crucial advantage – customer retention is significantly higher than with the conventional sales cycle, with customers concluding a service contract for an average of four years. As these are rolling contracts, the contract period is extended for a further four years with every expansion of the IT infrastructure. Contract durations of eight to nine years are therefore entirely realistic.

Tesedi and Annuity Management –

assistance and support with GreenLake sales

The service-only distributor Tesedi, a subsidiary of the Annuity Management Group (AMAG), has many years of experience with long-term maintenance and service agreements and their structured management and targeted extension. Just like the GreenLake ‘IT as a service’ model, this renewal management offers an opportunity for long-term customer retention and recurring turnover. Based on its expertise, Tesedi is far more familiar with the challenges in the service sales cycle than any other hardware distributor and is therefore able to offer precisely the kind of support that resellers need for successful growth in this market.

Tesedi is currently the leading HPE-certified distributor of the GreenLake services. Twelve projects have already been realised, in which the distributor was able to support the partners with realisation and administration. Tesedi will significantly ramp up its support in the future and will also offer sales support.

Conclusion

‘IT as a service’ models offer customers flexibility and agility, conserve the capital base and improve IT resource capacity utilisation. In an increasingly complex, digitalised world, companies and organisations of virtually any discipline and size can benefit from these advantages and generate competitive advantages. For resellers, switching from hardware sales to a usage-based model initially entails additional costs and a fundamental change in the sales cycle. In the long run, however, they will benefit from long-term customer retention and recurring opportunities for additional business – as long as they have a strong partner such as Tesedi at their side that has a fundamental understanding of business with recurring contracts and turnover and has been executing such business successfully for years.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!

What opportunities do warranty renewals bring for Tesedi?

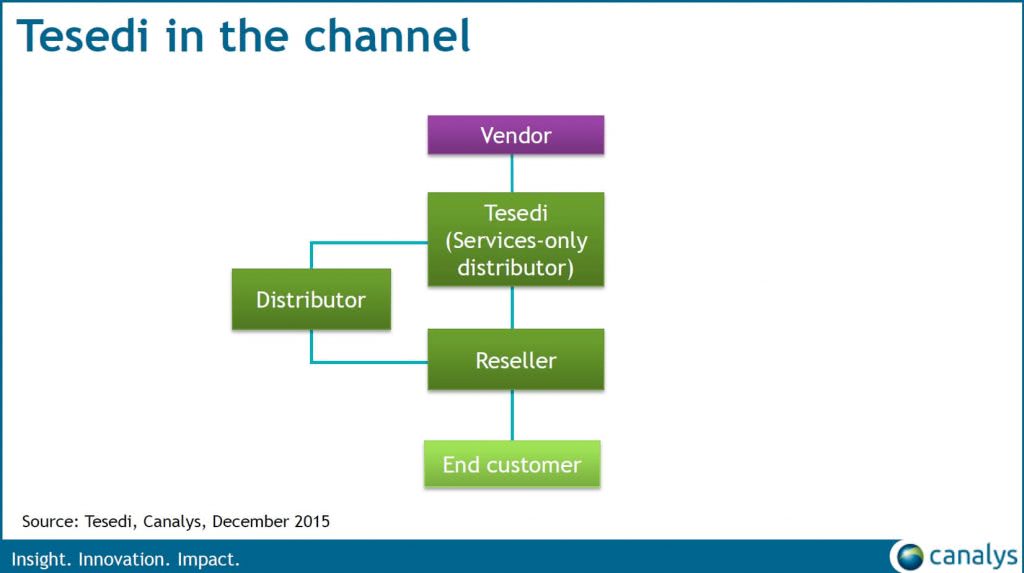

Distributed by Tesedi with permission from Canalys

Introduction

Warranty renewals (or extended warranties) on enterprise infrastructure can open up important revenue streams for the channel, even if they lack the appeal of other hot-topic IT areas. Dedicated business models have emerged to serve this opportunity. Tesedi is a German services-only distributor, under the aegis of parent company Annuity Management AG, providing warranty renewal and annuity management services to resellers, primarily on behalf of Hewlett Packard Enterprise. The company has built up significant expertise, with a platform capable of handling complex data and analytics. It operates in Germany, Switzerland and France, alongside Hewlett Packard Enterprise processing teams in Bulgaria and India. Tesedi generated around €25 million (US$27 million) in revenue last year, up by 15% in 2013. This year, it expects this to increase to €30million (US$33 million), with highest growth of 23% in its home market in Germany.

Driving the sale of warranty renewals through the channel can be challenging for vendors. Resellers can be reluctant to invest time and effort when returns can be relatively low, even on complex infrastructure. Customers may not have the specific budgets available or may regard extended warranties as unnecessary.

Resellers may also see vendor extended warranties as competing with their own post-sales services. For vendors such as Hewlett Packard Enterprise, the involvement of a dedicated distribution partner with the software tools to manage renewal processes on behalf of resellers can be important. Tesedi claims to have more than doubled Hewlett Packard Enterprise’s renewal orders in its core markets of Germany and Switzerland over the last six years, with the average value of each renewal being around US$8k.

Once an initial warranty has expired, Hewlett Packard Enterprise provides and underwrites service contract renewals that resellers can offer to end-customers. Tesedi helps partners to sell these renewals, monitors and tracks changes to the end-customer’s product mix, distributes policies and manages the billing process. The complexity of managing warranty databases, generating contracts for each renewal sale, as well as analyzing data to target groups and improve services is immense. Tesedi has a dedicated team that supports renewal management for Hewlett Packard Enterprise and provides information on contracts that need to be adjusted, changed, approved, or up- or cross-sold. Its tools are fully integrated with those of Hewlett Packard Enterprise, as part of its contract management service offering.

Tesedi also on-boards new partners and countries for Hewlett Packard Enterprise a process that typically takes around three months for a country and helps channel partners to engage with customers in selling Hewlett Packard Enterprise service contracts. Data analytics play a significant part in improving renewal rates. In addition, Tesedi has put together an incentive program for Hewlett Packard Enterprise partners in this area. Contracts are typically billed annually, and partners receive bonuses for reaching revenue targets, while new business targets will also earn rebates. Combined gross margin for the partner on warranty renewals is up to ten percent, depending on their performance.

Warranty renewals

The market for warranty renewals faces significant changes over the next few years, particularly with the shift to managed services. For example, warranty renewals are likely to be bundled more frequently into continuous managed service contracts. Moreover, with more servers and storage sold into service provider data centers, this shifts the customer for the warranty service, thereby carrying implications for the channels selling these services.

Therefore, scale is critical for distributors of warranty services. However, for smaller, regional specialists such as Tesedi, expanding beyond core markets can be difficult due to cultural barriers. For example, as a German company, Tesedi has struggled to expand its French presence. An alternative model to establishing local presence is to work with other IT distributors who have reach into local markets. Tesedi partners with a number of distributors in this respect.

One of Tesedi’s biggest competitors is MaintenanceNet, a global specialist with a strong focus on Cisco but also working with Hewlett Packard Enterprise, Fujitsu, Lenovo and distributors such as Ingram Micro. MaintenanceNet provides service renewals and data analytics through the use of its contract management tool, called Service Exchange, and its AutoQuote software engine. Its model, with an architecture similar to Tesedi’s, has been highly successful. MaintenanceNet’s revenue was above US$3 billion in 2014.

However, since MaintenanceNet was acquired by Cisco in Q2 2015, other vendors may be less keen to allow their service contracts to be managed by a competitor, and they will not want to see Cisco benefiting financially from future recurring revenue streams. This provides Tesedi, as an independent company, with an opportunity to expand beyond Hewlett Packard Enterprise and offer a similar solution to vendors who may now be looking elsewhere for their service renewals.

Disclaimer:

The written content of this document represents our interpretation and analysis of information generally available to the public or released by responsible individuals in the subject companies or the results of market research conducted with third parties, but is not guaranteed as to accuracy or completeness. It does not contain information provided to us in confidence by the industry. Market data contained in this document represents Canalys’ best estimates based on the information available to it at the time of publication.

Canalys has given permission to Tesedi to share this document. No further dissemination is allowed. If you wish to share information with the press or use any information in a public forum then you must receive prior explicit written approval from Canalys.

Copyright © Canalys 2015. All rights reserved.

Related Solution

With the neutral service-only positioning, the channel renewal support service supports both distribution and IT resellers in all renewal management tasks.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!

5 steps towards professional contract management

Many manufacturers focus too much on acquiring new customers yet neglect the renewal of existing contracts, i.e. their renewal management.

This is a big mistake, as professional contract management would enable them not only to increase their revenues, but also to improve customer loyalty.

Maintaining and developing existing customer relations and contracts are important components of a sustainable and successful corporate strategy. Yet surprisingly this tends to be ignored by many companies at the senior management level. According to a survey conducted by analysts at Gartner’s, investments in recurring revenues have dropped from 13th to 14th position in the list of priorities among CEOs. Not only is this alarming, it is also economically unreasonable. Bain & Company have calculated that it is six to seven time more expensive to acquire a new customer than to keep an existing one.

Moreover, a company can achieve above-average, sustainable levels of profitability if it runs a successful system of renewal management, i.e. the professional management and renewal of service, support, maintenance and licence agreements. Margins sometimes even exceed 50 per cent. Moreover, successful contract renewal always leads to recurring revenues over a number of years. With prudent contract management, even new business can be increased by an average of 10 to 15 per cent per year.

Reasons for inadequate renewal management

Apart from lack of interest among senior management, successful contract management is largely hindered by organisational obstacles. Quite often a number of different contracts are in place with a customer, all covering different periods and subject to different terms of renewal. Contractual relations, too, are often diverse: some contracts have been concluded directly, while others involve one or more distributors, and others again come under the responsibility of channel partners.

The following five steps can resolve this dilemma and lift contract management to a new level:

Gain an overview

All the existing contracts with a given customer should be collected in a central place, no matter how big or small they are and regardless of whether a contract is for several hundred euros or whether it involves six-digit figures. Professional renewal management contractors are available for this purpose, offering their own software platforms.

Do something about it

In many cases contract renewal is effected either late or merely as a reactive response. Don’t wait until the contract has terminated or is about to terminate, but contact your customer in good time. This means you can discuss contract renewal in peace and quiet and, if necessary, adjust existing contracts to any changes in circumstances, rather than having to find less ideal solutions under pressure of time and cost.

With this second step, too, it is immensely important to maintain an overview of all the existing contracts and the periods they cover. Professional solutions are available, offering timely reminders of impending contract negotiations and giving you a list of the terms and conditions that need to be negotiated – at a simple mouse click.

Think ahead

The major drawback of conventional, reactive contract management is that it stops out from considering potential cross-selling and up-selling opportunities, as everything has to be done quickly and the contract is threatening to expire.

On the other hand, if you have the necessary overview and a proactive, forward-looking renewal management, you may be able to increase your new business by 10 to 15 per cent per year. But you’re not the only one who benefits from this strategy. By drawing your customer’s attention to shortfalls in their current arrangement and by optimising the support and service landscape, you are also helping them. This results in a better relationship and greater loyalty towards you.

Make your customers successful

We live in a world where product comparison websites, customer ratings and competitors are merely a mouse click away, so that it is no longer enough simply to “push” products and solutions onto the market. The same applies to support, service and licence agreements. Instead, you should have solutions where you feel just as responsible for your customer’s success as they do. This means keeping an eye not only on all your contracts but also on the way they are used. If, for instance, you find that a customer has purchased a hundred software licences but only uses two of them, it would be good to point this out to them directly and proactively and then help them find a solution – before a competitor does so.

Let someone help you

Professional renewal management is anything but trivial, especially if you need to manage contracts coming from both direct and indirect channels. There is a danger that the channel will see itself as disadvantaged by the formulation of renewals and will therefore only help half-heartedly in your implementation. To ensure professional renewal management, it is therefore indispensable that you should use a neutral entity with an overview of all stakeholders, an entity which can find the best solution for everyone who is involved.

Conclusion

Renewal and the management of service, support, maintenance and licence agreements are complex and time-consuming. Companies therefore often fail to leverage any existing potential. Instead, they handle renewals reactively or, in the worst case, neglect them altogether. Such companies are effectively giving away money, as contract renewals can deliver returns of 50 per cent or more, which makes them extremely high-margin while also offering potential for new business. Investment in a professional renewal management system therefore pays off within a very short space of time.

Related Solution

With the neutral service-only positioning, the channel renewal support service supports both distribution and IT resellers in all renewal management tasks.

Related Solution

The Contract Renewal Service proactively supports manufacturers of direct customers in end-to-end renewal management.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!

Renewal Management – Potential improvements and opportunities

Greater margin, more satisfied channel partners and more transparency through professional contract management.

Exectuive Summary

With margins that are sometimes above 50 per cent, it is highly profitable for OEMs (original equipment manufacturers) to renew existing contracts. According to Morgan Stanley the share of recurring service revenues in total earnings rose from 30 to over 40 per cent for OEMs last year. Yet despite this level of significance, the renewal of active and expiring maintenance, support and service contracts is almost at the bottom of priorities among senior management. According to Gartner, investments in recurring revenues are given 13th place (out of 14) by CEOs.

Renewals have low energy for senior management.

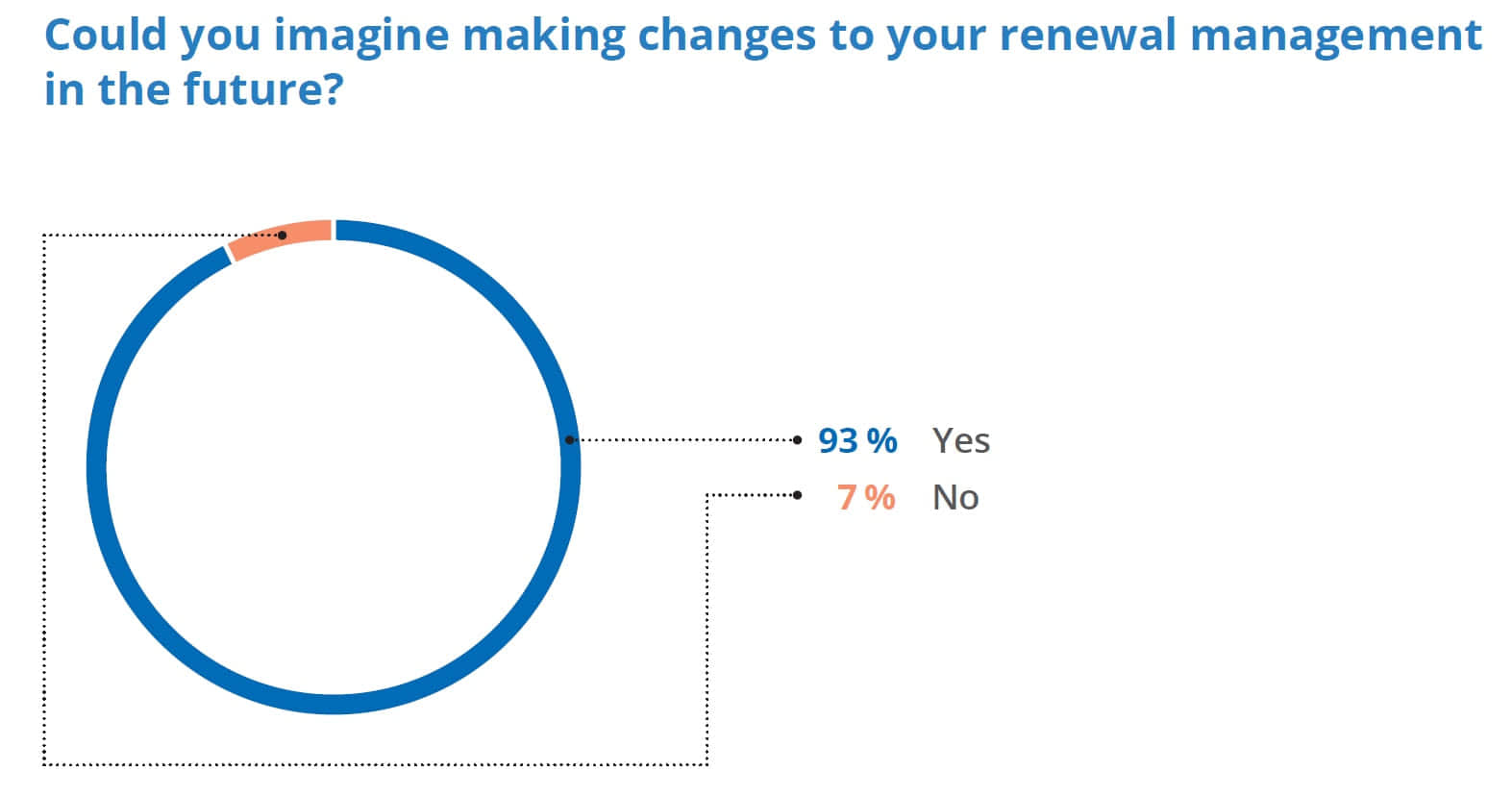

Room for optimisation can also be found among those with direct responsibilities for renewal management. This emerged recently from a survey conducted by Annuity Management AG, a company which specialises in the management of revenue lifecycles and service revenues. The survey shows that over half of the respondents make no distinction between direct and indirect renewal business and over 60 per cent are not directly measuring upselling or cross-selling results. This lack of focus on existing customer relations can be very costly. The acquisition of new customers does, after all, require up to seven times as much investment as efforts to retain existing customers, and every additional euro earned through cross-selling and upselling can pay its way up to five times as much through contract renewals.

60 percent of renewal managers do not measure the success of up-selling and cross-selling activities deirecty.

One element that plays a particularly important role in contract management is the channel. 85 per cent of the manufacturers surveyed by Annuity Management AG use the channel either as an exclusive method of distribution (14 per cent) or in Renewals have low priority for senior management. 60 per cent of renewal managers do not measure the success of upselling and crossselling activities directly. parallel with their direct business (71 per cent). Nevertheless, indirect distribution is not included and supported in renewal management as much as might be necessary, even though over 60 per cent of the respondents surveyed by Annuity Management feel that there is a need for action when it comes to looking after channel partners in their renewal management.

85 percent of the manufacturers use the channel as a method of distribution.

Furthermore, several factors make it difficult for the channel to ensure successful renewal management. Quite often the responsibilities for a customer’s contracts are not bundled, either for the manufacturer or the distributor, so that the impending renewal cannot be managed in any standard or consistent manner. Also, there are potential channel conflicts when manufacturers decide to handle lucrative contract renewals themselves, while passing on relatively low-revenue renewals to their partners.

Lack of consistent management and potential channel conflicts make renewal business difficult.

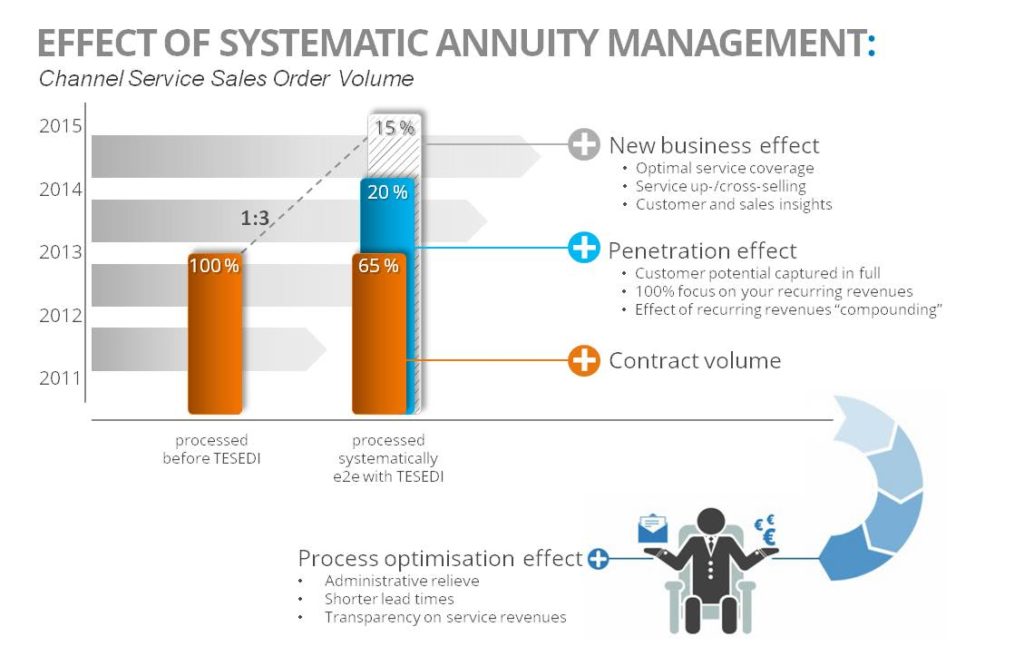

To solve these problems, to make renewal management attractive for the channel and thus to achieve a significant increase in the rate and volume of contracts, it seems worthwhile to use a neutral contractor who specialises in renewals. Such a contractor then bundles and supports all the activities involved in renewal management. Partners can be confident that they will not be sidelined in the contract management, that they can offer the best possible support for their customers and that they can achieve a substantial return on investment when they contact customers and negotiate contract renewals. Using the example of renewal management for Hewlett Packard Enterprise (HPE) Germany, the White Paper shows how such a professional partner can help to boost the renewal rate by up to 20 per cent per year.

A professional partner can help to boost the renewal rate by up to 20% per year.

Introduction

To solve these problems, to make renewal management attractive for the channel and thus to achieve a significant increase in the rate and volume of contracts, it seems worthwhile to use a neutral contractor who specialises in renewals. Such a contractor then bundles and supports all the activities involved in renewal management. Partners can be confident that they will not be sidelined in the contract management, that they can offer the best possible support for their customers and that they can achieve a substantial return on investment when they contact customers and negotiate contract renewals. Using the example of renewal management for Hewlett Packard Enterprise (HPE) Germany, the White Paper shows how such a professional partner can help to boost the renewal rate by up to 20 per cent per year.

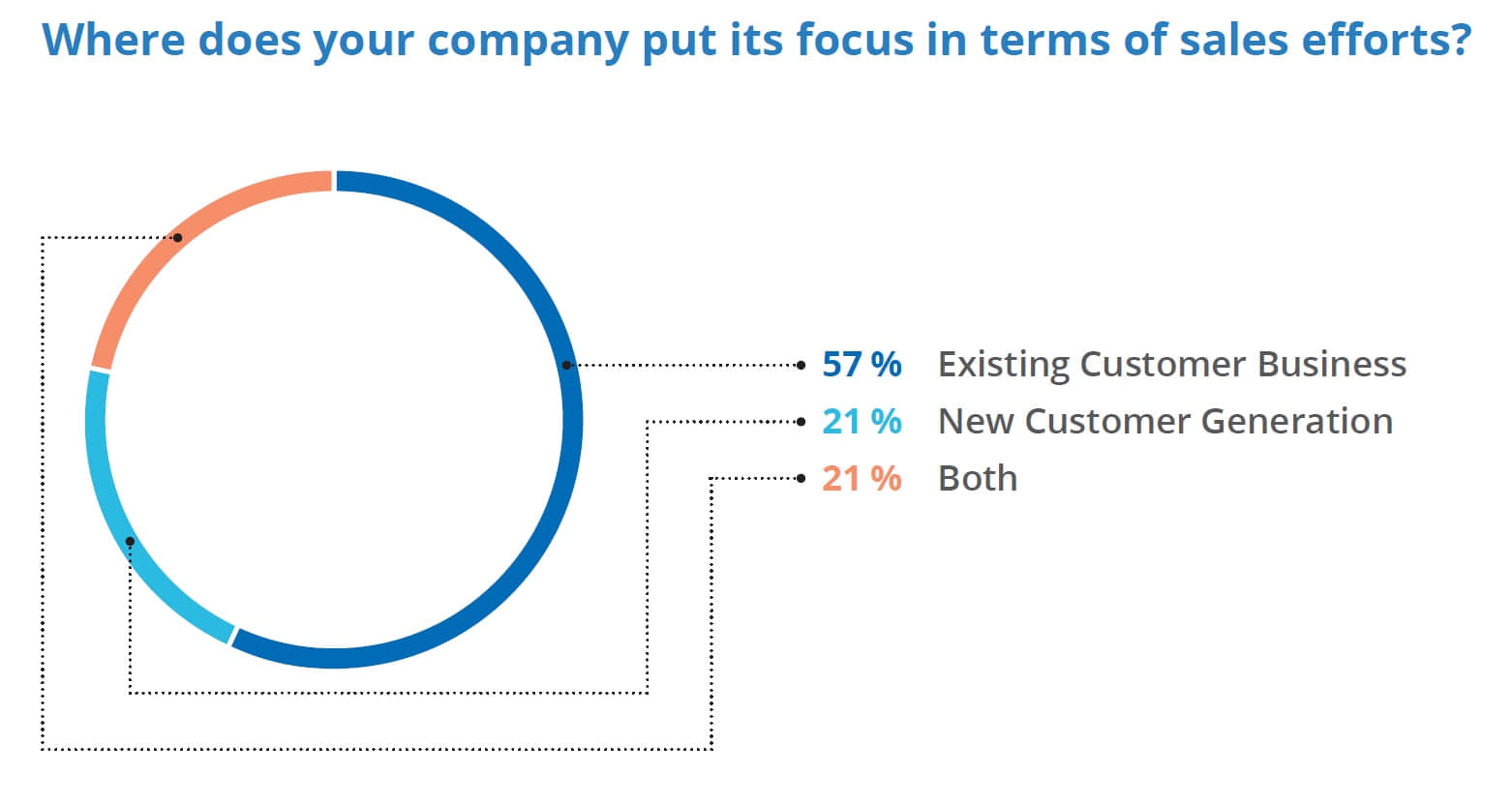

Renewal manager's perspective

More than half of all renewal managers put the main focus on managing existing customers, while 21 per cent believe that it is at least as important to focus on retaining existing customers as it is to acquire new ones. This was the result of a survey by Annuity Management among 18 major manufacturers in the IT industry, including Dell, Hewlett Packard Enterprise, IBM, Microsoft, Cisco and SAP as well as companies in other industries such as Phillips and Abbott Laboratories. Over 80 per cent of OEMs in the survey say they used the channel as a method of distribution, and 14 per cent even use it exclusively. On average, 56 per cent of revenue is made via the channel, and 80 per cent of customers are served through the channel.

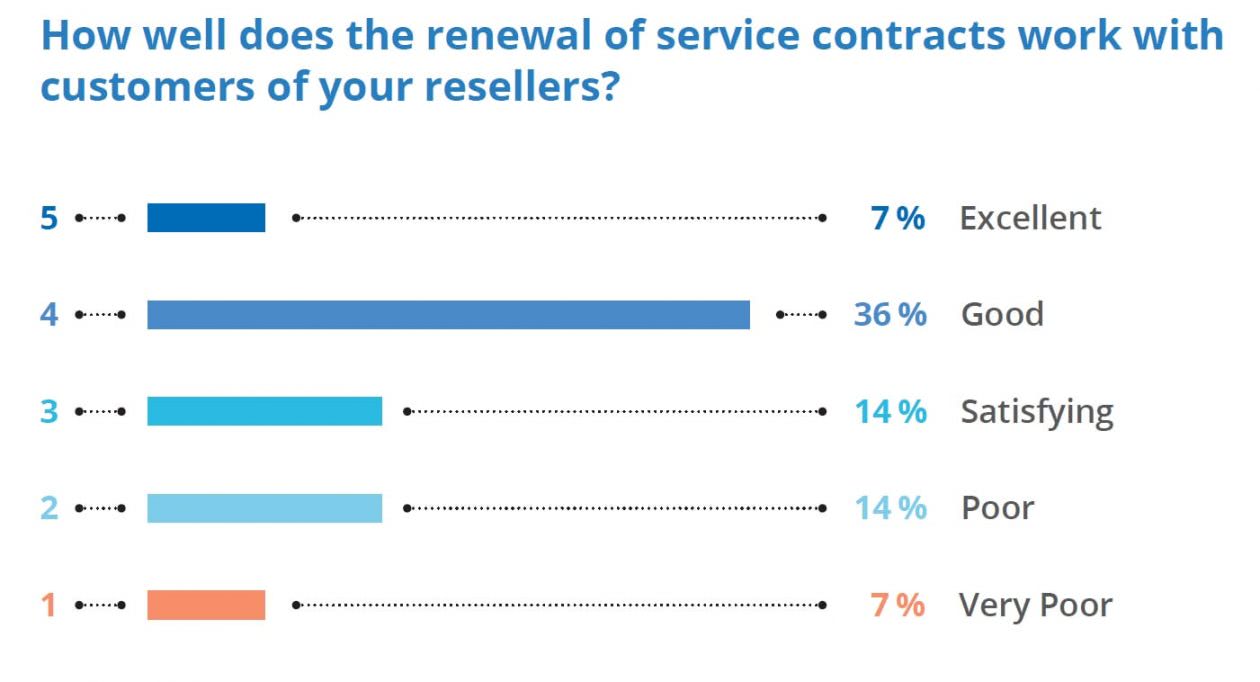

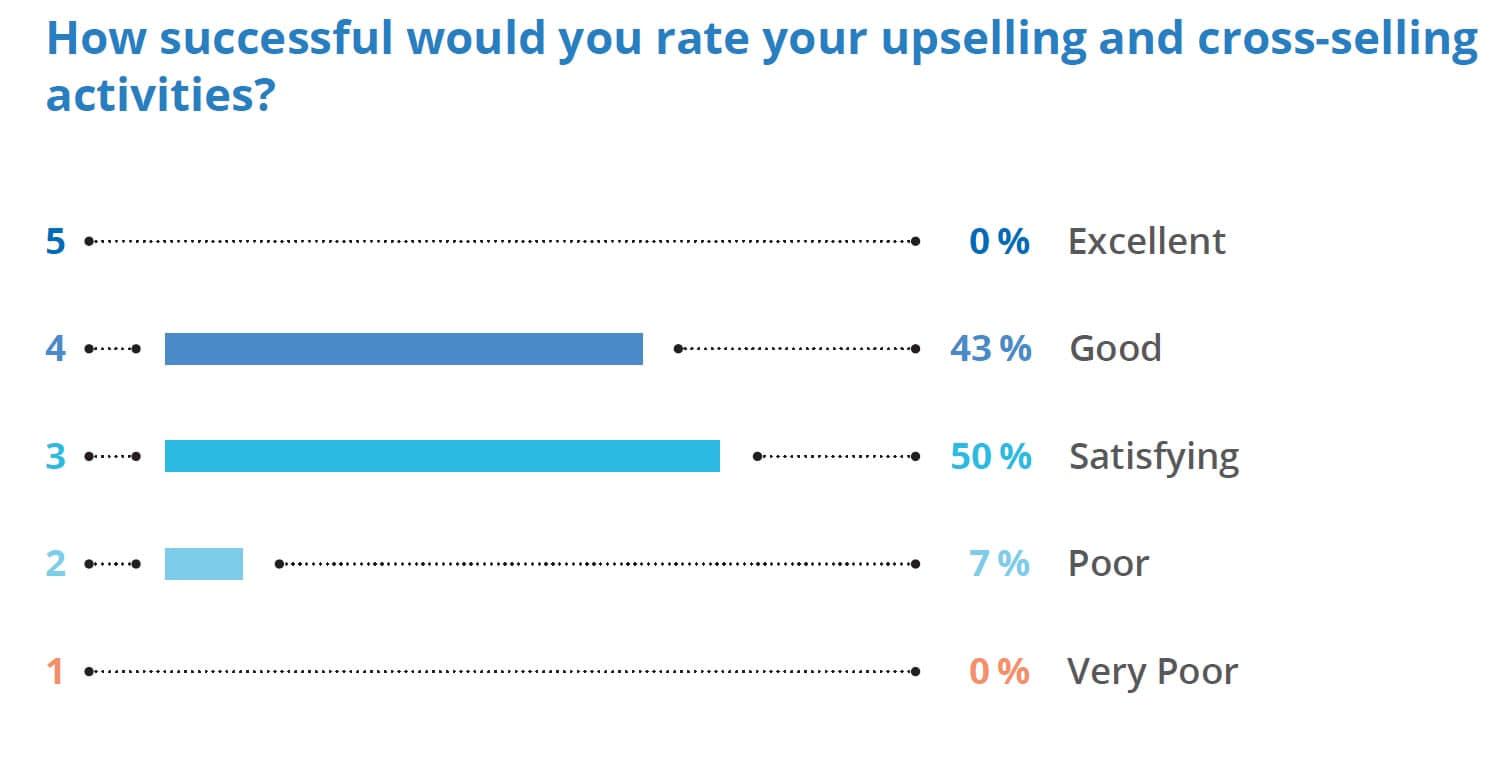

At the same time, service business is increasing in importance. Just under 80 per cent of respondents describe it as “important” or “very important”. It has an average revenue share of 38 per cent (and the percentage is rising). 86 per cent of respondents see renewal management as “important” or “very important”. 71 per cent have dedicated teams for it, and 21 per cent use external contractors for this purpose. Only 7 per cent of respondents say they have no specific renewal managers.

Nearly 90 per cent of respondents describe their renewal management as “very good” or “outstanding”. Companies are somewhat less satisfied with renewal management where customers of their channel partners are concerned. This is an area where only 43 per cent give top ratings. However, half of all respondents do not distinguish between indirect and direct sales in renewal management. Over half show only average or below-average satisfaction with their upselling and cross-selling processes. Half of all respondents doubt whether the existing measures are sufficient to leverage the full potential of renewal management.

Senior management perspective

While renewal managers are at least partially aware of the need to ensure the retention of existing customers, this awareness is missing almost completely at the senior management level. According to Gartner, investments in recurring revenues are given 13th place (out of 14) by CEOs. This has also been confirmed in the Annuity Management survey which found that 65 per cent of the surveyed renewal managers feel there is no interest among senior managers. 80 per cent say that this area is suffering from gross underinvestment.

Channel partners' perspective

Renewal management processes are often seen by channel partners as obscure. The responsibilities for a customer’s contracts are distributed across different manufacturer’s departments and several distributors. Instead of receiving a standard view of a customer’s renewal situation, partners have to deal with a large number of small contracts which are not coordinated among themselves and which have very different terms. Sometimes the partner even receives incorrect or outdated information from the manufacturer. Moreover, if a company handles contract renewal both directly and indirectly, this may cause conflicts within the channel. As a result, channel partners cannot be sure whether all of a customer’s contracts have really been submitted to them or whether the manufacturer may perhaps be trying to conclude especially lucrative renewals directly.

This lack of transparency makes it difficult to ensure successful renewal management for a partner. There is no trust and no motivation to invest more time, energy or resources in the renewal of contracts. An Annuity Management survey among channel partners shows that over 90 per cent would welcome more proactive support for their renewal management.

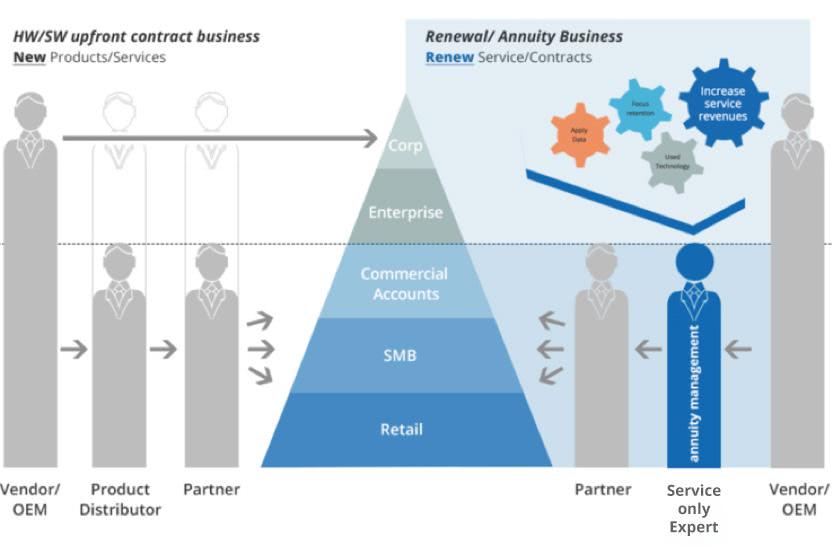

The role of the service-only expert in renewal management

Both manufacturers and channel partners are overwhelmed by the full-scale management of contract renewals. This is where neutral specialists can be helpful, as they can provide more efficient processes, state-of-the-art IT and a clear focus. Ultimately, this shows itself in a higher renewal rate and more business through upselling and cross-selling.

The service-only expert plays a crucial role in this process. Being totally focused on the renewal of service contracts, such a specialist does not compete with the manufacturer, with up-front distributors or with resellers. Instead, their only role is that of an expert on service contracts and, as such, they proactively support the entire renewal process. Experts support the channel in selling renewals, in monitoring performance, in writing quotations, in discovering potentially new upselling/cross-selling business in the service area, in tracking the conclusion of renewals and in managing financial accounting.

Case study: Annuity management at Hewlett Packard Enterprise

Hewlett Packard Enterprise (HPE) is a global technology group that offers a wide range of professional hard and software as well as IT services and solutions. With over $30 billion in revenue per year and business activities in over 100 countries, HPE pursues a channel-focused approach in marketing its products and services.

The renewal management at HPE Germany gave the company a major challenge, due to its level of complexity. It was facing a situation of multi-channel distribution, a complex IT landscape with a large variety of data sources and points of contact and continually changing hardware configurations that often required new service level agreements and software and licence updates.

HPE Germany understood that its channel partners needed support in managing their existing service and maintenance contracts. For example, partners were not receiving the information they needed for correct quotations, did not have up-to-date customer details and were not using any upselling potential. Another element that made contract renewals unattractive was the amount of time that had to be invested in managing them.

As a result, the company’s renewal rates failed to meet expectations, partners were frustrated and corporate customers were left without the necessary service and maintenance contracts. Not only did this have a negative effect on customer satisfaction, but it also prevented any systematic approach to new business.

HPE Germany therefore wanted to find an expert in annuity management. It chose Tesedi, a subsidiary of Annuity Management AG. Tesedi specialises 100 per cent in renewal management services. It does not sell hard or software, so that it has a very clear focus and is trusted by manufacturers, distributors and the channel. Supported by a suite of highly specialised IT systems, Tesedi covers the entire lifecycle of renewal management, from the registration of new contracts and partners, through the tracking of all renewal-specific information, to the provision of sales support and contract optimisation. Tesedi also supports HPE channel partners by ensuring correct profiling and pricing and by offering contracts.

Thanks to support from Tesedi, HPE more than tripled its renewal revenue in its core markets – Germany and Switzerland – over the last six years, with the average contract volume being about EUR 12,000. This is all the more crucial as each renewal contract brings in recurring revenues for about five years. Tesedi has calculated that every euro made through renewal management can be multiplied by a factor of 3.4, including a 20% tech refresh per year. In addition, renewal management has led to an average 10-15% increase in new business per year.

Conclusion

The importance of ensuring the retention of existing customers has so far failed to penetrate to the senior management level. Sales and marketing continue to focus on acquiring new customers, even though this is up to 7 times more expensive than endeavouring to retain existing ones. Pent-up demand can be observed, in particular, in renewal management via channel partners. Renewal management via the channel is complex, long-winded and effective due to the complexity of contracts and supply chains, inadequate and incorrect information from manufacturers and distributors and also potential channel conflict between direct and indirect sales. Not surprisingly, therefore, partners want to see more support for the renewal of service and maintenance contracts.

This support can best be provided by neutral contractors focus on renewal business alone. Such experts can warrant a standard and consistent renewal management, create transparency and ensure that the process is handled professionally and on time. Acting as interfaces between manufacturers, distributors, the channel and customers, they can place renewal management on a totally new level, thus achieving long-term revenue increases of over 20 per cent per year.

Related Solution

With the neutral service-only positioning, the channel renewal support service supports both distribution and IT resellers in all renewal management tasks.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!

Channel Renewal Management challenges and Solutions

Businesses with indirect sales and numerous partners are faced with the particular challenge of managing this ecosystem in such a way that they can take advantage of as many opportunities for contract extensions and renewals, as well as for cross-selling and up-selling, as possible. Proactive renewal management supports partners and prevents channel conflicts.

The extension of existing service and maintenance contracts is highly profitable for providers. Margins of 50 per cent are not uncommon and there are also significant opportunities for new business. This revenue is particularly attractive, as it recurs every year. Every pound acquired in this way is multiplied over the entire contract term.

Most providers use the channel not only for sales, but also for renewal management, (the management of existing service and maintenance contracts), as demonstrated by a survey from Annuity Management AG. According to this, 85 per cent use the indirect sales channel, while 14 per cent use it exclusively. Over 60 per cent of participants also wish for better support from their channel partners in the case of contract extensions.

This is not surprising, as channel renewal management is a complex process. Different points of contact, incorrect or outdated information from providers, hardware and software acquired directly or through various different distributors, as well as different contract terms, contract partners and volumes, make management confusing and often inefficient, particularly if providers hold onto high-volume contracts with good margins and only pass on the less lucrative ones to their channel partners.

Complexity, non-transparency and a lack of confidence in actually succeeding in agreeing all contracts with a customer (and not just the less attractive ones) diminish the motivation of channel partners to invest time and money into renewal management. Contracts subsequently expire or are taken over by third-party maintenance providers (TPM).

This unsatisfactory situation is not due to any ill will on the part of the channel. On the contrary, over 90 per cent of the channel partners surveyed by Annuity Management would welcome more proactive support from providers with regard to renewal management. Providers are also not interested in ignoring the channel, but are simply overwhelmed by the complex nature of renewal management.

What needs to be done

For successful renewal management, it is first and foremost vital to compile all existing service and maintenance contracts with a customer, regardless of whether they were originally agreed directly with the provider, a distributor or a channel partner. After this, the responsibilities for contract extensions should be defined and scheduled so that there is ample time for renewal prior to expiry of the contract. Ideally, contact should be made three months prior to expiry of the contract.

During this process, opportunities for cross-selling and up-selling should also be explored, such as upgrading to a higher service level or identifying ‘naked box’, hardware from customers that is not, or is no longer, covered by service contracts.

In general, these tasks are not performed adequately by the provider or by channel partners. It is therefore advisable to seek the assistance of a specialist service-only provider. They not only have the necessary expertise in the management of complex contract types, but also in processes and IT systems which simplify contract management, ensure transparency, and significantly reduce workload.

The experts consequently support both the provider and the channel in relation to all renewal management tasks, such as offer preparation, performance tracking, cross-selling and up-selling, and generation of new business. As a neutral partner, they have both the provider’s and partner’s interests in mind and can thus prevent channel conflict.

Rescue in time of need

Without a channel support programme of this nature, channel partners are not always able to renew expiring contracts in time, even though the providers give them over 120 days in some cases. This is a problem for the provider, as they stand to lose revenue and customers. This is where channel rescue experts come in. These companies have made a business out of rescuing expired contracts. They only come into contact with the customer after the renewal period has lapsed. To avoid channel conflict, the customer is always informed of the opportunity to contact their channel partner directly in order to obtain a contract extension. If a customer would still like to request a contract extension from the service-only renewal rescue expert, they can do this, but they will not receive any discount on the list prices. Studies confirm that around 40 per cent of customers contacted in this manner successfully conclude a contract extension with their partner – a lead generation factor for the channel that should not be underestimated.

If all else fails and the partner takes no action despite receiving reminders, or the customer does not contact the partner as arranged, the rescue expert then gets involved again and contacts the customer after 30 days if no request has been received. With this type of rescue, the specialist typically also identifies up to 30 per cent naked box, and can thus generate additional business, which in turn can benefit the provider and, ultimately, the channel.

Renewal and channel rescue services complement one another perfectly, as together they cover the entire lifecycle of a contract and thus maximise opportunities for renewals and corresponding new business.

Benefits for providers and partners

Cooperation with service-only end-to-end providers presents the following benefits for the providers and their channel:

Systematic, thorough renewal management prevents erosion of the install base and ensures high coverage rates.

Professional support from sales experts generates additional new business.

Professional processes, systems and tools enable higher productivity and quality with significantly reduced management costs.

Complete transparency across all contract details enable market trends and sales opportunities for new business to be identified, and up-selling and cross-selling measures to be defined.

Conclusion

Renewal management through or with channel partners is complex, error-prone and time-consuming for providers. It often leads to channel conflict, and does not allow the full potential for new business, as well as up-selling and cross-selling associated with existing service and maintenance contracts, to develop. A service-only provider specialising in contract management can help to clear things up. It guarantees fair, transparent conditions for providers and channel partners, increases the intrinsic value of renewal management, and also reduces management costs. Even expired service contracts can be rescued with professional assistance. With this type of professional renewal management, renewal rates can be increased by over 20 per cent per year, while over 10 per cent new business can be generated through up-selling and cross-selling as well as through identification of hardware without maintenance and service contracts (naked box) – a step which quickly pays off for providers and channel partners.

Related Solution

With the neutral service-only positioning, the channel renewal support service supports both distribution and IT resellers in all renewal management tasks.

Related Solution

The reminder and rescue service wins back service contracts that have been thought already lost.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!

Customer Success is a competitive advantage

By actively helping your customers to use your products and services successfully, you can lower churn rates and generate additional revenue.

The business models of manufacturers and service providers have changed significantly in recent years. One-off sales of products or services have fallen by the wayside and long-term contracts with lower yet steady revenue have become much more significant. Perhaps the most well-known representatives of this trend are manufacturers such as Microsoft, Adobe and Salesforce which provide subscription models for their software, or cloud providers such as Amazon Web Services and Google. However, even hardware manufacturers are generating increasingly large percentages of their proceeds from recurring revenue by, for example, providing usage based rental models of infrastructure as a service (IaaS).

This trend has changed the focus and significance of customer relations significantly. Reactive customer relationship management has become proactive customer success management. Supporting customers properly over the entire life cycle is a key success factor. Although customers can be attracted more easily than with purchase models, they can drift away just as quickly as they are not tied to one provider through long-term investments. Therefore, contracts are only extended and expanded if the user is satisfied with the product and is able to use it to meet his or her business targets successfully. In contrast, dissatisfaction leads to higher cancellation rates and the churn rate increases. This is all the more alarming because even negligible changes in the churn rate can have a considerable impact on revenue.

The positive contribution proactive support can make is reflected in the many years of experience of Annuity Management in renewal management, i.e. the administration of existing service and maintenance contracts. By contacting customers or the relevant channel partner in good time, the vast majority of expiring contracts can be extended and a significant volume of new business can even be generated.

Data collection and analysis are crucial

Generally speaking, in the service and subscription model, businesses have access to the data necessary for monitoring customer success. With usage data, they can identify how their products or services are being used. For example, the frequency and scope of use are two of the most informative parameters. Are essential features rarely being opened, or not at all? Has the customer posted 50 accounts but is only using one? Does the customer often close the application after just a few seconds? Information like this can be used to define KPIs or thresholds which trigger an alarm if they are not met. This allows the provider to take suitable steps, call the customer, arrange a screen-sharing session, send links to video guides on certain features or offer training.

Customer success management can even play a crucial role in indirect sales and the activities of the channel partner can be planned and managed with much more precision when customer satisfaction can be taken into consideration. If, for example, a product is not being used, the relevant partner can be notified and motivated to contact the customer and offer support.

Support with customer success management

Special tools and expertise are necessary in order to be able to generate informative usage profiles, monitor customer success, identify negative trends and implement the correct measures. Many times, these two things are still not available. Many businesses do not have a department dedicated to customer success management. Responsibility for ongoing customer support is often borne by the customer acquisition department; a risky strategy as that department has completely different duties and is therefore unable to operate customer success management properly. Subscription models are often launched even though the organisational requirements for successful customer management have not been met. There is a reason why Michael E. Porter, a professor at the renowned Harvard University, and James E. Heppelmann, CEO of PTC, state that customer success is one of the key aspects of digitisation in their article in Harvard Business Review entitled ‘How Smart, Connected Products Are Transforming Companies’.

Even if providers have identified the significance of customer success management, it is difficult to find suitable employees. The advertisements for customer success manager jobs currently far exceed the supply, which means that the situation will not change significantly in the foreseeable future.

It is therefore advisable to work with a customer success management specialist. Working with the provider, the specialist can define and monitor the key customer success indicators and collect the usage data needed to monitor them on a continuous basis. If the agreed thresholds are fallen short of or exceeded, the specialist becomes active, contacts the end customer or sales partner and offers support.

Conclusion

Customer success management measures customer satisfaction and customer success. This makes it an effective alarm system for subscription services and a key success factor for businesses that rely on recurring revenue. If you are able to increase the success and satisfaction of your customers, you can lower the churn rate reliably, increase customer willingness to agree to contractual extensions and expansions and strengthen your customer relations. However, defining the right customer success indicators, collecting and interpreting the necessary data and implementing appropriate measures to counter falling customer satisfaction require the correct tool set and a lot of expertise. These are often not available internally and can only be built up over the long term. It is therefore advisable to work with a specialist who can support businesses on their way to happier, more successful customers.

Ideally, customer success management does not end with customer support, but rather also affects product development, sales and marketing. Ultimately, customer success cannot be viewed separately from product quality and customer communication. Customer success management is therefore a strategic interface which can also provide businesses with valuable information about customers and their habits and requirements. Businesses that rely on subscription and rental models now and in the future would be wise to seek the support of a customer success management specialist.

Related Solution

Satisfied customers remain long-term customers. The Customer Success Management Service proactively monitors customer behaviour in usage-dependent service agreements.

Contact

Are you interested in talking with us about the topic?

We are happy to hear from you!